|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

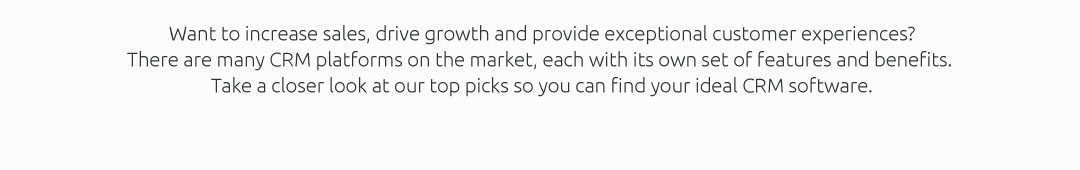

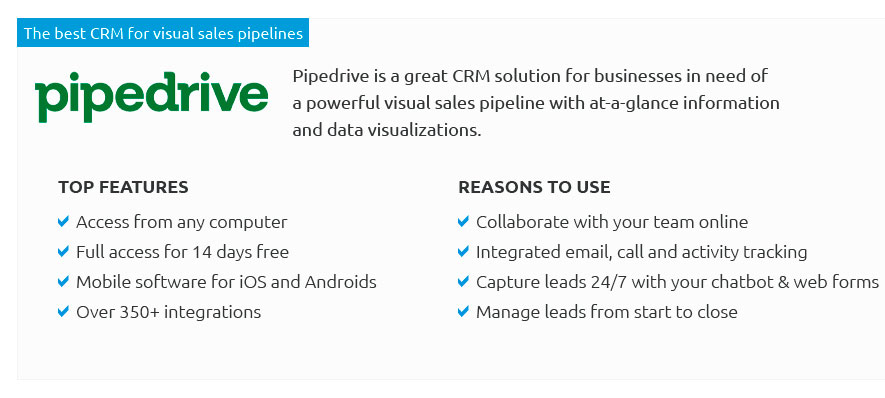

Exploring CRM for Mortgage: An In-depth AnalysisIn the ever-evolving landscape of the financial sector, particularly within the mortgage industry, the implementation of Customer Relationship Management (CRM) systems has become not just an advantage but a necessity. The integration of CRM systems into mortgage operations can significantly enhance efficiency and improve customer interactions, yet it comes with its own set of challenges and considerations. As we delve deeper into this topic, it becomes clear that the role of CRM in mortgage is multifaceted, providing both substantial benefits and some noteworthy drawbacks. To begin with, let's discuss the undeniable advantages that CRM systems bring to the mortgage industry. One of the most compelling benefits is their ability to centralize customer data, offering a holistic view of each client's journey. This not only streamlines operations but also enables mortgage professionals to deliver personalized service, a crucial element in an industry where trust and personal connection are paramount. By having access to comprehensive client profiles, mortgage advisors can tailor their communications and recommendations, enhancing customer satisfaction and fostering loyalty. Moreover, CRM systems facilitate better lead management. In a sector where competition is fierce, the ability to efficiently track and convert leads can be a game-changer. With CRM, leads can be categorized based on various criteria such as stage in the buying process, potential value, and source of the lead. This organized approach ensures that no opportunity is missed and that each lead is nurtured appropriately, ultimately boosting conversion rates and driving business growth. Additionally, CRM platforms often come equipped with robust analytics tools. These tools provide valuable insights into customer behaviors, market trends, and operational efficiency, enabling mortgage companies to make informed, data-driven decisions. This analytical capability is particularly beneficial in forecasting and risk management, areas that are critical to the long-term success of mortgage businesses. However, despite these advantages, there are some disadvantages to consider. One of the primary challenges is the cost associated with CRM systems. Implementing a sophisticated CRM platform can be a significant financial investment, not just in terms of software acquisition but also in the training and support required to effectively integrate it into existing processes. Smaller firms, in particular, may find this cost prohibitive, potentially limiting their access to the benefits that CRM systems offer.

Despite these challenges, the role of CRM in the mortgage industry remains undeniably important. As the industry continues to adapt to technological advancements, the strategic implementation of CRM systems can provide a competitive edge. The key is to carefully weigh the costs and benefits, ensuring that the chosen system aligns with the company's specific needs and capabilities. In conclusion, while CRM for mortgage presents both opportunities and challenges, its potential to transform the way mortgage companies operate and engage with customers is profound. As with any technological tool, success lies in thoughtful implementation and ongoing adaptation to the ever-changing business environment. https://mortgagetech.ice.com/products/encompass-crm

Use automated one-to-one marketing with professionally designed, individually tailored communications combined with business intelligence to capture attention, ... https://setshape.com/mortgage

The best all-in-one mortgage CRM. Increase productivity by 41% by automating your sales and marketing. Purpose built and proven to close more loans! https://mloflo.com/

Take a proven mortgage business building system and enable it with cutting edge technology and you get mloflo! The only mortgage CRM on the market that not ...

|